Key Takeaways

- Swap out complicated spreadsheets for one-glance dashboards. Visually engaging budgeting tools work best for ADHD brains, turning numbers into intuitive signals and reducing overwhelm.

- Automate your invoicing to prevent missed payments. Use invoicing software that auto-sends reminders, tracks paid versus unpaid invoices, and syncs with your calendar. This minimizes forgotten follow-ups and prevents cash flow gaps.

- Establish “money check-in” rituals that are genuinely enjoyable. Anchor your regular finance reviews to existing habits (like Friday wind-downs or Monday morning resets) so money management becomes automatic, not another task lost at the bottom of your list.

- Break big financial goals into playful micro-milestones. ADHD-friendly budgeting is all about chunking savings or income targets into small, short-term wins that fuel motivation and make your progress clearly visible.

- Turn ADHD quirks into strengths by gamifying your finances. Create mini-challenges or set up systems where you earn “points” or rewards for achieving your financial targets. Tap into novelty and dopamine to power your follow-through.

- Choose technology that reduces decisions and distractions. The right finance apps automate categorization, flag exceptions, and keep everything organized in one place. This helps you avoid the cognitive drain of hunting for information or doubting your own records.

- Celebrate stability instead of endless hustle. Sustainable ADHD finance isn’t about pushing harder, but about building resilient systems that minimize stress and unwelcome surprises. This frees up your creative energy for work you truly care about.

Ready to turn financial chaos into clarity? Keep reading as we explore streamlined budgeting methods, ADHD-proof invoicing workflows, and the tiny systems that help solo founders maintain their spark, and stay solvent.

Introduction

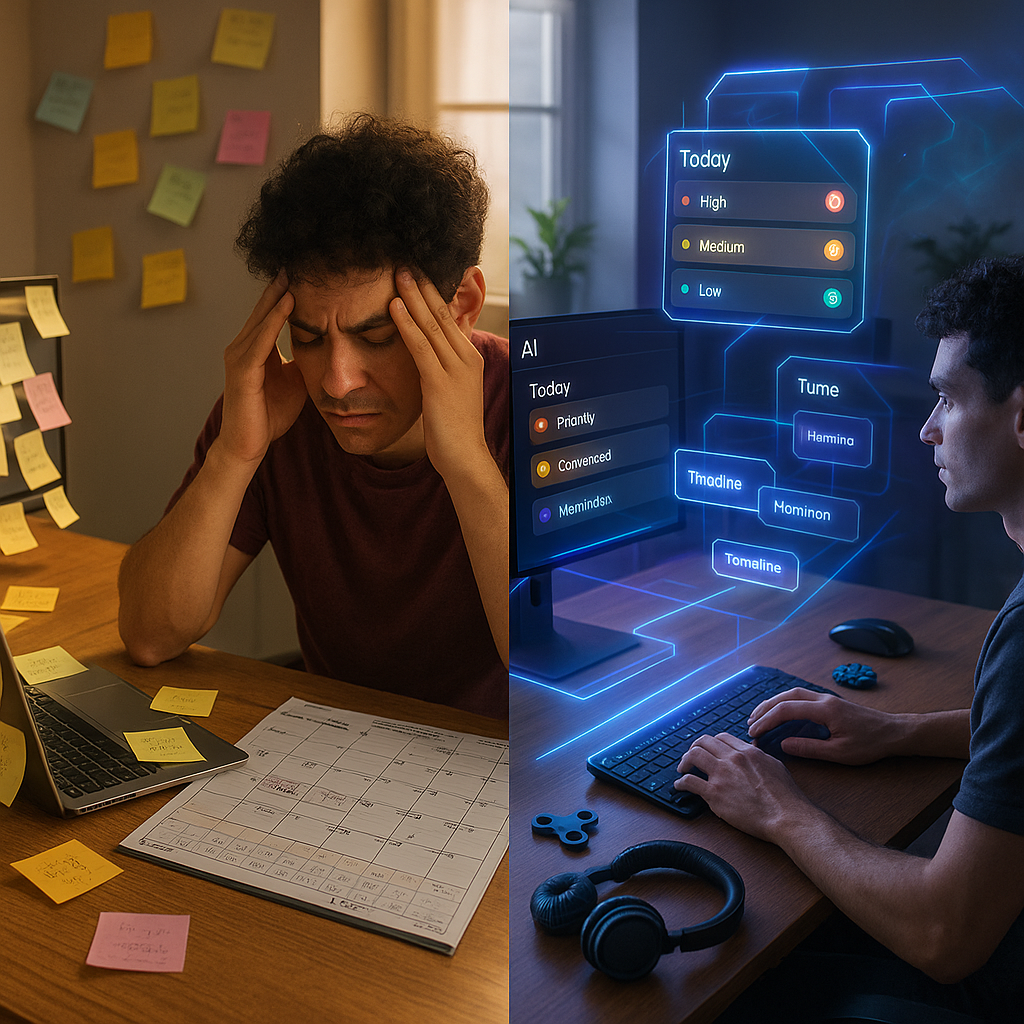

Financial chaos isn’t just background noise for solo founders with ADHD. It can shape every decision, ripple through each week, and spark those familiar bursts of late-night stress. When you are both the CEO and the finance department, standard budgeting advice and spreadsheet overload rarely stick. Instead, ADHD-friendly money systems can transform anxiety into clear signals, steady cash flow, and routines you’ll actually look forward to.

By trading overwhelming formulas for one-glance dashboards, automating invoicing, and gamifying your goals, ADHD finance shifts from confusion to clarity. Let’s uncover the simple budgeting and invoicing systems made for solo founders, so you can spend less energy firefighting your finances and more energy on building a business that works for your brain.

Why Traditional Financial Systems Fail ADHD Entrepreneurs

Traditional financial management methods can fall flat for solo founders with ADHD. These prevailing systems often demand sustained attention, meticulous record-keeping, and strong tolerance for tedious detail—all areas that challenge the ADHD brain’s executive functioning.

The core problem isn’t a lack of intelligence or business savvy. Rather, ADHD entrepreneurs typically grapple with activation energy, misjudging time, and working memory gaps, making conventional financial habits nearly impossible to maintain. Your brain isn’t broken; it simply runs on different operating software, requiring systems that fit how it processes information.

When mainstream advice says “check your accounts daily” or “schedule weekly bookkeeping time,” it’s prescribing solutions based on skills that ADHD makes difficult. This mismatch can trigger a cycle that’s all too familiar:

- You start with high hopes and create ambitious tracking systems.

- The newness wears off after a few days or weeks.

- You miss a session due to hyperfocus elsewhere or simple overwhelm.

- Shame and avoidance creep in as unfinished work piles up.

- Financial tasks become emotionally loaded and even more off-putting.

- In frustration, you eventually ditch the system altogether.

This loop is not a personal failure. It’s a predictable result when neurotypical systems are imposed on a neurodivergent brain. The real solution isn’t working harder at uncomfortable methods, but designing financial frameworks compatible with your ADHD wiring.

An ADHD-friendly financial system puts your strengths front and center while accommodating the challenges. With thoughtful design, money management can go from your business’s weak link to its backbone. Let’s break down how to create systems that genuinely work with your unique cognitive style.

Understanding Your ADHD Money Patterns

Before building new financial systems, it’s important to understand your own ADHD money patterns. These are not character flaws, but predictable neurological responses that can be worked with instead of against.

Common Financial Challenges for ADHD Entrepreneurs

ADHD impacts financial management in practical, nuanced ways that traditional advice often overlooks:

- Inconsistent tracking: Money comes in, but tracking who’s paid (and who hasn’t) gets fuzzy, fueling cash flow uncertainty.

- Impulse spending in hyperfocus: Excited by a new idea, you might purchase tools or invest heavily without a broader financial overview.

- Delayed invoicing: Drafting and sending invoices feels boring or draining, so they get postponed. This leads to late payments and erratic income.

- Tax-time avoidance: The complexity and anxiety of taxes inspires procrastination instead of action.

- Invisible financial obligations: Out-of-sight subscriptions and recurring charges quietly drain resources, seldom noticed until much later.

These scenarios are common among entrepreneurs with ADHD and can create recurring pitfalls if not addressed with specifically tailored solutions.

Identifying Your Personal Financial Executive Function Gaps

Each ADHD entrepreneur faces unique challenges. Pinpointing which executive functions are toughest for you is a crucial step toward effective solutions:

- Working memory issues: Forgetting transactions, losing receipts, or neglecting payment follow-ups.

- Time management difficulties: Underestimating the time needed for financial tasks, missing deadlines, or sending invoices late.

- Task initiation problems: Knowing you need to handle finances, but struggling just to get started.

- Emotional regulation challenges: Feeling anxious or ashamed when reviewing financial info, leading to avoidance.

- Organizational weaknesses: Setting up but not maintaining filing systems, with records scattered across digital and physical spaces.

Recognizing your personal patterns isn’t about fixing your brain. It’s about building external supports that play to your unique strengths and smooth over the rough spots.

Leveraging ADHD Strengths in Financial Management

ADHD comes with distinct financial challenges, but also powerful strengths that can fuel success:

- Hyperfocus: When harnessed, this lets you set up automated systems or batch financial work in short bursts of high productivity.

- Creative problem-solving: ADHD entrepreneurs often invent unconventional yet effective financial shortcuts or workarounds.

- Pattern recognition: The ability to spot financial trends or anomalies quickly, enabling smarter optimization and risk mitigation.

- Crisis management: Thriving in urgent situations allows for quick pivots when deadlines or financial hurdles loom.

- Adaptability: Comfort with change enables faster adjustments to new systems or workflows compared to those who strictly follow the rules.

The secret isn’t to eliminate your ADHD traits, but to build financial systems that transform these quirks into advantages.

Building a Minimal Viable Financial System

For entrepreneurs with ADHD, the best financial system isn’t the most comprehensive one. It’s the system you’ll actually stick with. Enter the Minimal Viable Financial System (MVFS): a simple, robust structure that delivers the clarity you need without overwhelming your executive function.

The Three-Account Framework

Start with structure that simplifies, not complicates. The three-account framework creates clear boundaries that reduce decision fatigue and make your money visible, no complex categorization required:

- Revenue Account: All client payments and business income land here first.

- Operations Account: A preset percentage moves here to cover business expenses and investments.

- Tax & Profit Account: Another percentage automatically shifts here to handle tax obligations and your own pay.

Separating money into purpose-specific buckets minimizes accidental overspending and externalizes discipline, so you don’t have to rely on willpower or memory.

Suggested allocations can get you started. Maybe 60% for operations, 25% for taxes, and 15% reserved for your profit. But tailor these to your business needs. The primary goal is to create consistent, visual boundaries.

Automating Money Movements

Automation is your best friend for reducing friction. Remove manual transfers and let your bank move money for you on a schedule:

- Set up your accounts for automatic transfers based on fixed percentages.

- Use regular, scheduled movements to eliminate “decision moments.”

- Enable notifications for low balances or exceptions, so nothing slips by unnoticed.

Many modern business banks (like Wise Business, Mercury, or Relay) offer these automation tools natively. Invest a single hyperfocused session to set everything up. Once done, your financial system will largely run itself, whether your executive function is firing on all cylinders or not.

Visual Money Management for the ADHD Brain

Visual cues can transform abstract finances into actionable insights. Move from rows of numbers in a spreadsheet to engaging dashboards that make your financial health instantly apparent:

- Choose banking or budgeting apps with graphical dashboards (like YNAB, Copilot, or Monarch Money).

- Employ color-coding for expense categories, making it easy to spot problems at a glance.

- Use progress bars or pie charts to visualize goals and spending, rather than relying on mental math.

- Build a single “command center” dashboard for all key financial data.

For those who benefit from physical systems, consider a whiteboard or magnetic budget board in your workspace. One solo founder I coached said moving to this tactile, colorful system made finance tangible and even enjoyable.

This minimal system doesn’t aim for perfection. It aims for stability and clarity. By making money management visually intuitive and automating routine decisions, you provide enough structure for reliability without the risk of system collapse.

Friction-Free Invoicing Systems for ADHD Entrepreneurs

If there’s one financial task that trips up ADHD entrepreneurs repeatedly, it’s invoicing. Getting paid shouldn’t require a feat of willpower. The answer is to create a friction-free system that minimizes decisions, manual steps, and memory drains.

Designing the Path of Least Resistance

An optimal invoicing workflow removes as much cognitive load as possible. Start with these steps:

- Template everything: Build out standardized invoice templates tailored to each service or client type. Save them in your invoicing software for repeat use.

- Limit customization: Restrict fields to bare essentials: client information, service description, and amount. Let everything else auto-fill.

- Standardize terms: Set payment terms (Net 15, Net 30) and make them your default across clients.

- Automate numbering: Use software features that auto-generate invoice numbers, removing another mental hurdle.

- Integrate with project management: Connect your invoicing tool with your existing workflow. Project completion should trigger invoice creation automatically, so no need to remember extra steps.

Applications like FreshBooks, QuickBooks, or Wave provide robust automations. For freelancers, tools like Bonsai, AND.CO, or even Stripe can handle recurring invoices and send reminders when payments are late, cutting down on follow-ups and minimizing awkward conversations.

Beyond the basics, consider using Zapier or Make to link your project management tools (Trello, Asana, Notion) directly to your invoicing workflow. For example, when a project card moves to “Done,” an invoice draft is instantly created.

Industry Applications: ADHD-Friendly Financial Systems in Action

While these approaches are essential for solo founders, the impact of ADHD-friendly finance systems stretches across industries:

- Healthcare: Clinicians and private practitioners managing inconsistent insurance payments can use automated categorization and reminders to minimize revenue gaps.

- Creative Agencies: Visual dashboards help creative professionals and freelancers balance unpredictable income and multiple active projects.

- Education: Tutors or academic coaches benefit from invoicing automation and scheduled financial check-ins, reducing overlooked payments.

- Consulting and Legal: Professionals can automate retainer management, contract billing, and compliance tasks for more reliable revenue, all while playing to the strengths of a neurodivergent mind.

- Retail and E-Commerce: Automated financial workflows help manage supplier payments, recurring inventory purchases, and split accounts to prevent cash flow surprises.

- Nonprofits: Visual, simple systems make budget allocation and donor tracking more transparent, even when executive functions are stretched.

No matter the sector, the principle is the same. Build structure that complements neurodivergent wiring and removes unnecessary friction.

Conclusion

Conventional financial systems often misalign with how ADHD and other neurodivergent brains operate. They demand skills that aren’t always on tap and trigger cycles of shame when lapses inevitably occur. By acknowledging that financial inconsistency, impulsivity, and avoidance are rooted in executive function gaps, not a lack of intelligence or willpower, founders can finally replace self-blame with self-understanding.

Minimalist, automated frameworks bring order to chaos, transforming money management into a repeatable, empowering process. By leveraging strengths like hyperfocus, creativity, and adaptability, and by turning finances into engaging, visual experiences, ADHD entrepreneurs can create resilient systems that provide freedom and peace of mind.

Looking forward, those who build finance systems around their natural cognitive style will not only prevent burnout. They’ll unleash more creative and strategic energy to grow their ventures. Don’t wait for the perfect moment to master your business finances. Start with simple, sustainable steps and let your unique brain shape the tools, not the other way around.

Imagine your entrepreneurial path if finances stopped being a source of stress and became a seamless, invisible ally in your growth. The key isn’t adopting just any tools. It’s choosing the ones that truly work for how your mind operates.

Brains that spark. Tools that scale. Your financial clarity, and your next level of business, start here.

Leave a Reply